Why financial wellbeing is my biggest New Year’s resolution

IN PARTNERSHIP WITH UP

WORDS BY MAGGIE ZHOU

A change that’ll stick.

It’s hard to resist the clean slate a new year brings. There’s something so shiny and forgiving about a literal fresh page. January 1 marks a year unbothered by past mistakes – it doesn’t care about your missteps, failed hobbies or embarrassing moments.

Despite the fact I’ve only seen through one New Year’s resolution in my life (so far, I optimistically want to add), I’m a sucker for the annual process. 2024 is just around the corner, it’s the year I turn a quarter of a century and it’s the year I’ve decided I’ll get well and truly on top of my finances.

For more content like this, browse through our Life section.

Anyone who has grown up without financial literacy knows how daunting this is. You can’t be what you can’t see, and without understanding what financial well-being really looks like, it’s hard to create it for yourself.

It’s no surprise over 90 per cent of New Year’s resolutions fail – momentum is hard to keep. Instead of a hard-and-fast New Year’s resolution around a specific money goal, I’m dedicating the entire year to feeling more confident about finances.

This way of approaching resolutions was shared by the founder of Self Care Originals and Fashion Journal contributor, Rachael Akhidenor. “Perhaps the best New Year’s resolution [is] not to focus on arbitrary activities but instead, centre the goals around how I want to feel,” she wrote.

“By focusing on a feeling as opposed to a goal, the rate of failure [is] minimised. Instead of the resolution being something I either did or didn’t achieve, this feeling [is] my mere guiding light; the focus point that I could come back to again and again.”

Recently, Australian digital bank Up released a survey of over 54,000 Australians and found that we’re all feeling pretty subpar about our finances. The median reported financial well-being score across all participants was 55 out of 100 – with Boomers feeling happiest about money and Gen Z feeling the worst.

There’s a feeling in the air that this is changing. Up found that Millennials and Gen Z were the most optimistic about money, with the majority reporting their feelings about money are on the rise. The past year has shown how young Australians are willing to engage with money talk.

Over 130,000 Australians made voluntary HECS payments in May before their student debts rose by 7.1 per cent in June, an almost 300 per cent increase on the year before. Girl maths – the online trend that satirically looks at the ways women justify spending – puts a focus on gendered stereotypes of money.

View this post on Instagram

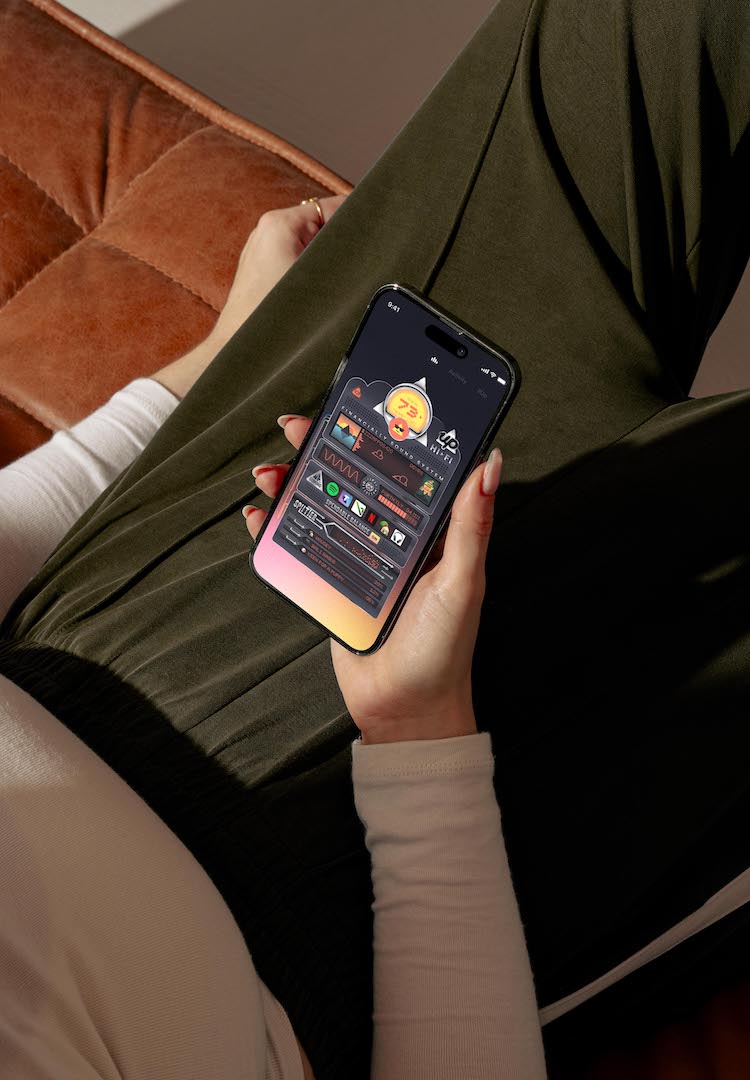

All around, there’s an openness in discussing the traditionally taboo topic of finances. Up’s latest feature, Hi–Fi, is an extension of this desire to take control of your money. The inbuilt money management system in Up’s digital banking app streamlines your payday income, upcoming bills and various money buckets into a one-page view. You can then see your spendable balance laid out in front of you.

Every few months, Up provides a check-in to see how you’re feeling about money. It isn’t just about figures lying in an account – it’s driven by emotion and mindset. To make your money resolution stick, just remember that consistency is king. It could be about knowing how much you’re spending each month, creating automated saving transfers or making (and sticking to) a budget.

Whether it’s putting away $5 or $50 a week, the act of regularity is essential in building a habit. Making massive and drastic financial goals typically burns people out in the process. Financial goals (and any New Year’s resolutions for that matter) should be doable and shouldn’t impinge on your living quality.

New Year’s resolutions aren’t there to measure perfection. New Year’s resolutions allow us a moment of earnestness to admit we want to do better. I’m sure you’ll stumble at one point or another in your resolution, but I’m just as sure you’ll pick yourself up.

The financial information contained in this article is general and doesn’t take into account your personal financial objectives, situation, or needs. It’s important to do your own research and consider getting in touch with a professional adviser to access specific information tailored to your own unique situation.

Take control of your money with Up’s Hi–Fi feature. Learn more here.