Budgets don’t work, but this advice can help you become more savvy with your dollars

PHOTOGRAPHY BY JASON HENLEY

WORDS BY ROSANNA WATTS

Do you know your financial phenotype?

Traditionally, finance has been perceived as a man’s world. Even just the idea of talking finances can evoke images of old men, probably wearing tweed and definitely sipping the sort of alcohol that’s described as dry, while pretending to enjoy some equally dry conversation.

I swear I’m genuinely struggling to recall a single woman I know personally who has pursued finance as a career. Which isn’t surprising, considering less than 30 per cent of Aussie economics undergraduates are female and women make up just 20 per cent of the financial planning sector. Plus, for the women who do pursue a career in finance, it’s still a struggle to gain the recognition they deserve, both in the field and in the media.

When it comes to personal finance, there’s no denying we’ve come a long way, but the scales are by no means balanced. A recent US study found that 49 per cent of women still let their partner take the lead when it comes to making financial decisions.

But Melissa Browne is on a mission to rewrite the ‘no girls allowed’ narrative surrounding finances. She is working with women through online courses and in-person seminars to help them become both business and finance-savvy.

Melissa wears many different pairs of shoes, one of them as an author of four (!!) books, including my personal favourite More Money for Shoes. But she’s also a financial advisor and coach, wellness advocate, social entrepreneur, speaker and educator.

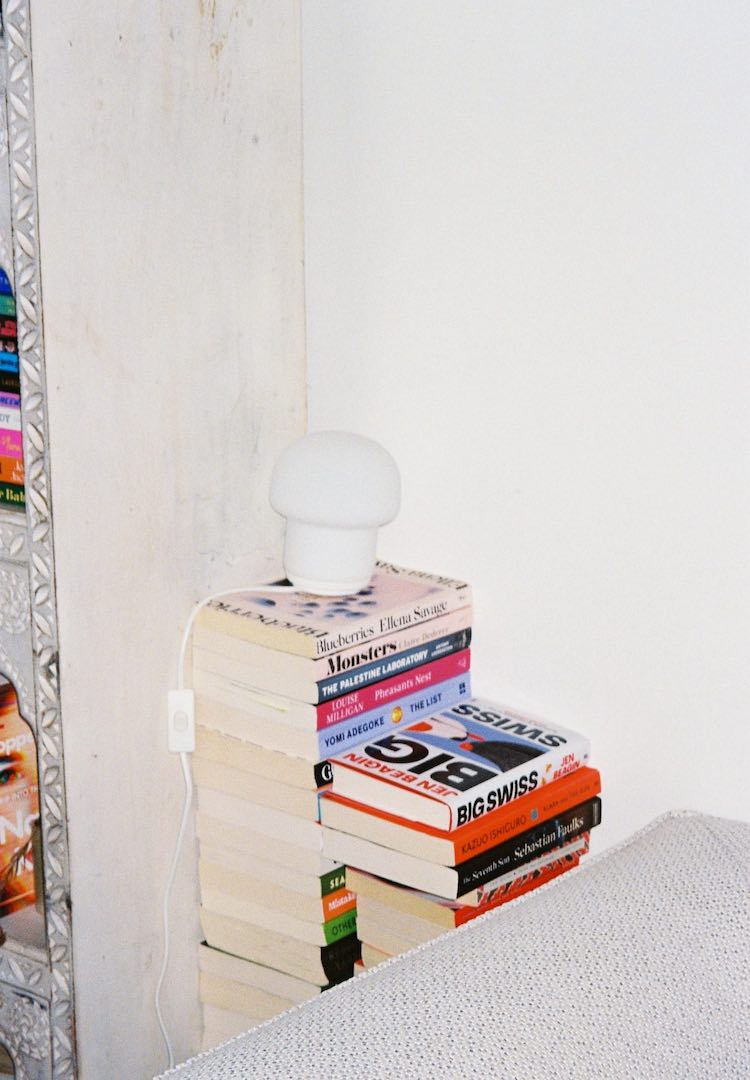

Her latest book Budgets Don’t Work (But This Does) just came out this month, and is all about discovering our specific ‘financial phenotype,’ so we can tailor our financial plans accordingly. If that raised a question mark for you, think of it like figuring out your body’s unique needs and creating a specific health and fitness plan tailored to you. But, of course, it’s for your finances.

Luckily, I interviewed Melissa on financial phenotypes and she did a much better job of explaining it than I ever could. So I’m letting her words speak for themselves. Below Melissa explains what the terms ’money story,’ ‘money environment’ and ‘money type’ mean, and shares her advice on crafting a highly-personalised approach to our finances.

Yes, this is the warm and reassuring light amidst the cold, stormy news of recession and job losses that you’ve been searching for. So, here’s to financial wellness. Oh, and having more money for shoes.

On working out your financial phenotype

“The financial phenotype is something that I put together to describe our complexity around how we are and how we behave with our money – we’re not just ‘spenders’ and ‘savers,’ which are the categories we’re often lumped into. The financial phenotype is made up of both nature and nurture. The nurture side involves the money story, which is the money messages or the money myths that we’ve grown up with and that we’ve accepted either from our peers, society or our parents. These are messages that we believe but aren’t necessarily true. One of the common stories people carry is: ‘I just don’t feel like I’m enough when it comes to money.’

“The second nurture component is the money environment, which involves both your online and offline environments. It includes the people you surround yourself with, the books you read, the TV shows you watch, who you’re following and how you’re behaving online, these can all shape your money environment. So, this is about being aware of and mindfully curating our environments. That’s not to say cut people out of your life, but you might put boundaries up and minimise certain people’s financial effect on you, while bringing other people into your life that model great financial behaviour that you can emulate. And the other part of the financial phenotype is nature which is the inherent way that we behave. I’ve broken this down into four different types, known as money types: The Worker, The Creator, The Discerner and The Relator.

“The Worker type is the most pragmatic, they’re very much about earning and their personal exertion. The Creator is the most idealistic, they’re about manifesting and imagining and designing. The Discerner, which is me, is probably the most judgmental and the most cynical, they’re about using their smarts to have success, which can mean book smarts or street smarts. The Relator is the most empathetic of the money types, the one most prone to want to rescue others. They’ll make their money through networking, collaborating and the social parts of life. Our money type isn’t just a nice-to-know; understanding how we inherently behave means we can figure out the specific financial habits that will feed into our strengths and minimise our weaknesses.”

On weathering a recession

“When it comes to managing finances during uncertain times like the current recession and the COVID-19 pandemic, it’s about doing the urgent and then doing the important. The urgent requires understanding what money we’ve currently got coming in and how long we’ve got it coming in for. Then, we should look at our expenses and pause or cancel anything that’s unnecessary for the time being, that way we can start building up ‘the buffer.’ We want to make sure we have a buffer of at least three month’s worth of expenses, so that if we lose our job, if our situation changes, if the pandemic goes on for longer, we’re not stressed because we know, ‘Okay, I’ve got that buffer there, so I can relax knowing that I’ve got some security.’

“That’s the urgent, but then there’s the important, which is the long-term work, like understanding your financial phenotype, figuring out what sort of life you want to design and creating goals to suit you, not your peers, or your parents or your friends. A lot of people have goals like, ‘Oh I should save 20 per cent of my money,’ but that doesn’t excite them. Whereas if they sat down and figured out what they really want, then they might be excited enough to change their spending.”

On the men’s club of finance

“There’s definitely a need to change the narrative around finance to make it more inviting to all, particularly young women, I really can’t say that strongly enough. Because more women today are going to be single and more of us are going to have a choice as to whether we have kids or not, we really want to take control of our finances early on and start to have some financial independence. Plus, from my experience in the financial advice world, too many financial planners target the Baby Boomers – those born between 1946 and 1965 – and just presume they’re going to get the kids one day. But I think young people, particularly young women, are after something different, so it’s important we address their particular needs and give them something they can actually get excited about.”

On what to do next

“Your money story, your money type and money environment are all nice to know and really helpful to know, but unless we put great habits in place as a result of knowing this, it’s not worth anything. So, the final step has to be taking action. And that means choosing to change your money story, choosing to amplify the good effects of your money environment and minimising the bad, while setting up great habits that are right for your particular money type.”

Head here if you want to hear more about Melissa’s work in the financial wellness space. And, if you’re ready to discover your Financial Phenotype and take control of your finances, grab a copy of Budgets Don’t Work (But This Does) here.